5 things to know about the convergence of risk and resilience

In 2020, Fusion partnered with OCEG to ask risk and resilience leaders across the globe about the convergence of risk management and resilience and where the industry is headed. When we surveyed that same audience early in 2021, one thing was evident: risk and resilience are converging at an unprecedented pace.

Integration of risk and resilience has been talked about in the industry on the order of decades. So, what do you need to know, and how do you catalyze this integration at your company?

1) The convergence is accelerating across all industries. While every industry went into the pandemic with a different perspective on the integration of the disciplines, as we exit the global crisis, all industries are seeing the integrated risk management approach and resilience as simply good business management.

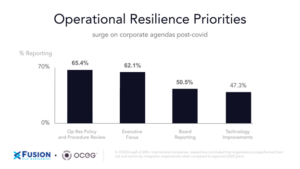

2) Risk and resilience are a board-level priority. Due to the impacts of the global crisis, acceleration of digital transformation, and new levels of operating ambiguity, building a risk-aware and resilient organization has become a new focus for boards and executive teams.

3) Risk and resilience are putting the customer at the center of their North Star. Supervisory authorities and industry leaders are converging on a new set of priorities governing building risk-aware and resilient operations.

This new perspective puts the customer at the center of risk and resilience efforts, leveraging an understanding of the criticality of the products and services your firm delivers to prioritize and deliver resilience where it matters most.

In this business continuity planning model, business leadership is the ultimate steward for risk and resilience, with leading firms integrating risk and resilience functions into the day-to-day operations of the business.

4) A repeatable standard for resilience is emerging. Regulators and leading firms alike are implementing a 5-step process for implementation:

- Identifying important services

- Mapping important services

- Proactively mitigating issues

- Setting tolerances by which to manage your business operations

- Modeling and testing your organization’s ability to manage within those tolerances

5) Deliver your North Star of resilience. Building a risk-aware and resilient organization requires a data-driven approach that adapts to changes in your operating environment. Fusion’s solution provides an integrated North Star framework that ensures your business is ready for whatever comes next.

The journey to resilient operations

Interested in learning more? Check out our recent webinar that discusses the results from the Fusion OCEG study and explores how enterprises are acting today to build a more resilient tomorrow.

Whether you are just getting started or are well into your resilience transformation program, technology can be an essential tool in making your plans actionable and scalable.

Contact us to learn more about how Fusion can help you build a more resilient global financial services operation or check out our most recent product showcase which highlights how Fusion’s purpose-built operational resilience framework can help you build a more risk-aware and resilient enterprise.