Organizations today depend on data for virtually every aspect of their business. From executive-level strategic vision and strategy to tactical risk assessments, managers leverage their data to serve their enterprise and help inform business decisions. But few organizations have impactfully thought through how their data should work together and relate, thus putting their business at risk.

Risk management, as it is now, is a data visualization issue. Data on a screen or in a spreadsheet is insufficient unless it is put into context for action. Here are just a few of the challenges that managers face in risk management on a daily basis:

- Not enough time to focus on strategic decisions

- Manual reporting efforts, getting stuck in documents and spreadsheets

- Unable to align meaningful data across an enterprise

- Accurately aggregating and disaggregating results up and down the organization

- Data integrity issues related to manual aggregation and manipulation of results

- Insufficient rationale or methodology for mitigating and accepting risks

Obtaining and accessing data is vital, but how an organization uses data in an established framework is the key to enabling a successful risk management program. Building such a program starts with an intuitive and thoughtful data model that considers the necessary relationships that need to be established. This data model can enable a manager to establish a clear vision for how integrated data can be impactfully visualized.

Organizations should operate their risk programs on a platform that standardizes data sets and considers data aggregation at the forefront. It is nearly impossible to employ an enterprise-wide analytical data model without this consideration.

Organizational Structures

Establishing a transparent governance and organization structure is crucial to understanding how a business works and where clear roles, responsibilities, and accountability are assigned. An effective risk management program needs to establish clear and intentional relationships that organize an enterprise by top-level business units, functional areas, products or services and, ultimately, processes.

Too often, organizations assess risk only at the business unit or departmental level without a goal of normalizing or aggregating risk results. Conducting risk assessments in organizational silos should be considered a practice of the past.

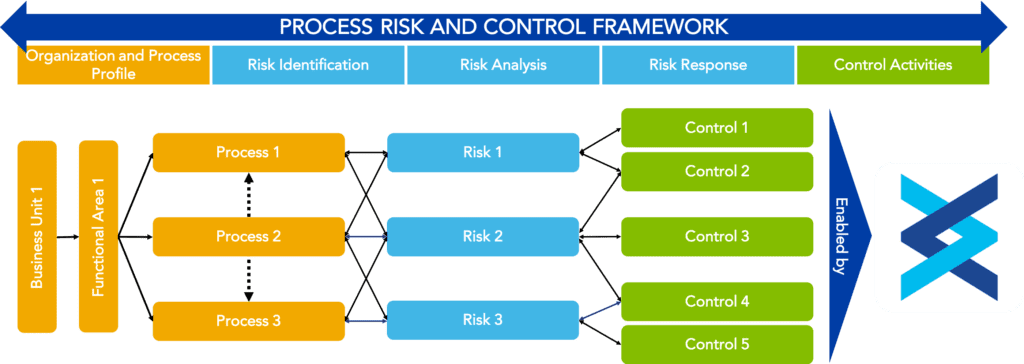

Process, Risk, and Control (PRC) Frameworks

Understanding an organization’s PRC framework creates a basis that enables an enterprise to build a robust process profile which dynamically links to risks and controls – this is critical in establishing and sustaining an end-to-end risk management process built on a powerful information and data foundation. This PRC framework empowers aggregation, dashboarding and reporting consistency and establishes the context for how risk intelligence is used and visualized throughout the enterprise.

Gathering, maintaining, and analyzing risk information becomes organized and intuitive in this perspective, using a digital information foundation tied to each piece of the PRC framework, as illustrated here:

Risk Categorization

Categorizing and creating a consistent and scalable risk taxonomy is critical to an organization. Risks can be accepted, managed, mitigated and transferred (with appropriate rationale). Create a multi-tiered categorization (e.g., L1, L2 and L3) of risk relevant to an enterprise that eventually results in targeted risk statements. This approach helps an organization identify and create risk statements tied to standardized risk categories. It also gives users the ability to expand the enterprise risk profile while operating under a guided framework.

Risk categorization allows for an enterprise to maintain the integrity of its top-level risk posture while facilitating the aggregation of risk information and data for dashboarding and reporting at various levels of the risk framework.

Control Categorization and Dynamic Inventory

Controls and control activities should exist in direct purview of an organization’s existing risks. Categorizing controls in an organized taxonomy can greatly enhance an enterprise’s view of its control environment.

Organize and create a detailed control inventory tied to existing control activities that provide alignment with the appropriate risks. This functionality will allow an enterprise to document control activities within its PRC framework and facilitate meaningful context for various operational risk management solutions (e.g., risk assessment, control testing, etc.).

Visualization!

Fusion makes data risk visualization possible. Organizations should consider re-visiting the baseline data model of how the enterprise is aligned to the structure, processes, risks and controls in a dynamic environment. With this established framework, supported by agile and fit-for-purpose technology, managers can truly obtain an enterprise-wide analytical view, tied to business strategy and objectives. This is a risk posture that puts data aggregation and visualization at the forefront.

What to know more?

Learn about Fusion’s expanded risk management and business continuity capabilities!